(Posted on 01/06/24)

Values for newbuild vessels of 180,000 DWT are up by c.5.45% from USD 66.09 mil to USD 69.63 mil according to Rebecca Galanopoulos Jones, Senior Content Analyst at Veson Nautical.

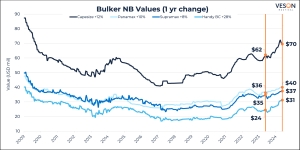

Bulker newbuilding values are currently at 15-year high, with increases across all sectors since the start of the year. This is due to a number of factors including strong market fundamentals and increased demand, high steel prices and shipyard costs. Capesizes have seen the most impressive gains with values for newbuild vessels of 180,000 DWT up by c.5.45% from USD 66.09 mil to USD 69.63 mil.

However, the majority of orders in 2024 to date have been split equally between the Panamax and Supramax sectors, each accounting for c.35% of orders placed. With a price difference of just under USD 3 mil apart in value, it is unsurprising that a number of owners have opted for the larger Panamax sector. Panamax Bulker newbuilding values for vessels of 82,000 DWT are currently at USD 40 mil compared to USD 37.26 mil for Supramaxes of 62,000 DWT.

High values have been supported by firm earnings, which have been moving upwards consistently since January. Panamax rates for one-year are currently at around 16,300 USD/Day, up by c.11%, yearon year as disruption in both the Suez and Panama canals have increased tonne mile demand for the Bulker sector, along with improving demand fundamentals from China.

Greek buyers have led Panamax newbuildings in 2024, accounting for c.45% of orders.

Notable new orders include 8 x Panamax Bulkers of 82,000 DWT ordered by Laskaridis Maritime, scheduled to be built at Penglai Zhongbai Jinglu and Hengli Shipbuilding and delivered in 2026, VV value USD 286 mil.

Whereas in the Supramax sector, it is the Chinese who have placed the majority of orders, with a share of c.35%. Notable new orders include 8 x Ultramax Bulkers of 64,000 DWT, ordered by HuaXia Financial Leasing, scheduled to be built at New Dayang Shipbuilding and delivered between 2026-27, sold for USD 34 mil each.

Veson Nautical delivers maritime freight management solutions and are trusted by buyers and sellers of bulk marine freight in every region of the world, Veson solutions are responsible for managing $122 billion in freight traded and moving 6 billion tons in annual trade each year.

AtoB@C Shipping, a subsidiary of ESL Shipping, has announced the successful delivery of Fleximar, the... Read more

Western Bulk, together with reputable Norwegian partners A/S J. Ludwig Mowinckels Rederi, Premium Maritime... Read more

Pacific Basin Shipping Limited, one of the world’s leading dry bulk shipping companies, has announced... Read more

Columbia Group anticipates a period of strong expansion as an increasing number of international shipowners... Read more

Norse?Ship Management has expanded its use of Smart Ship Hub’s high frequency sensor data and... Read more

As the maritime industry gears up to welcome the IMO’s STCW bullying and harassment training amendments... Read more

NORDEN has acquired the cargo activities of Taylor Maritime in Southern Africa (previously operated... Read more

Philippos Ioulianou, Managing Director of EmissionLink, has warned the IMO’s decision to delay... Read more

VIKAND has highlighted the need for cultural change in the maritime sector as reports of bullying, harassment... Read more

The maritime industry is experiencing a period of significant transformation, driven by rapidly evolving... Read more